Charter freight: aeronautics keeps pace, automotive and e-commerce ease off

The broker Chapman Freeborn provides a mixed assessment of the all-cargo charter market in 2025. On one hand, the demand related to aeronautics remains strong: the transport of engines, critical parts, sensitive equipment, and “AOG” operations continue to fill dedicated flights, often on an urgent basis. On the other hand, two major historical drivers – the automotive industry and e-commerce – are showing signs of fatigue, with a noticeable decline in volumes chartered compared to the peaks of previous years.

Aerospace still benefits from the accumulated delays in production lines and the necessity for manufacturers and equipment suppliers to avoid any line stoppages. This translates into regular charters of medium and long-haul aircraft to secure the transport of strategic components between Europe, North America, and Asia. In contrast, the automotive industry, hit by weaker demand and better logistical planning, has reduced its reliance on “emergency all-cargo.”

The same observation applies to a portion of e-commerce flows: after several years of hyper-growth, major players are optimizing their networks and shifting more volumes toward regular solutions or block-space contracts, which are less expensive than ad hoc charters. The market remains active on certain key corridors, but the frenzy of last-minute charters has significantly calmed down.

For freight forwarders and freight forwarding networks, this rebalancing requires a quick commercial adaptation. Chartering is becoming a niche tool with high added value again, rather than a generalized reflex as soon as demand surges. Actors capable of combining technical expertise (oversized load management, critical aviation, defense, energy) and the ability to set up a flight in a few hours maintain a competitive advantage.

In the medium term, this shift also suggests a normalization of supply chains after several years marked by crises and shortages. But it reminds us that air freight remains extremely cyclical: a new disruption, whether geopolitical, industrial, or health-related, could reignite, in a matter of weeks, an intense demand for charters. The shippers who have maintained structured relationships with the specialists in the segment will then be best positioned to benefit from it.

The post Charter freight: aeronautics keeps pace, automotive and e-commerce ease off appeared first on The Logistic News.

Share this post

Related

Posts

US Truckload Capacity Edges Higher as Major Carriers Rebalance Fleets

The Journal of Commerce’s Truckload Capacity Index (TCI) recorded a slight increase in the fourth quarter, reflecting a cautious expansion...

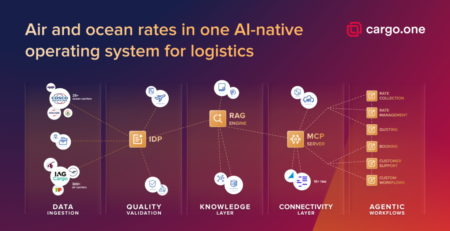

cargo.one Unveils AI-Native Operating System for Multimodal Freight

Air cargo booking platform cargo.one has announced the launch of what it describes as the industry’s first AI-native operating system...

Forwarders Brace for Delays and Rising Costs After Iran Strikes

Global freight forwarders are warning customers to prepare for delays, disrupted schedules and rising transport costs following missile strikes involving...

Air Cargo Operations Suspended Across the Middle East as Conflict Escalates

Air cargo networks across the Middle East have been severely disrupted following the rapid escalation of military tensions in the...