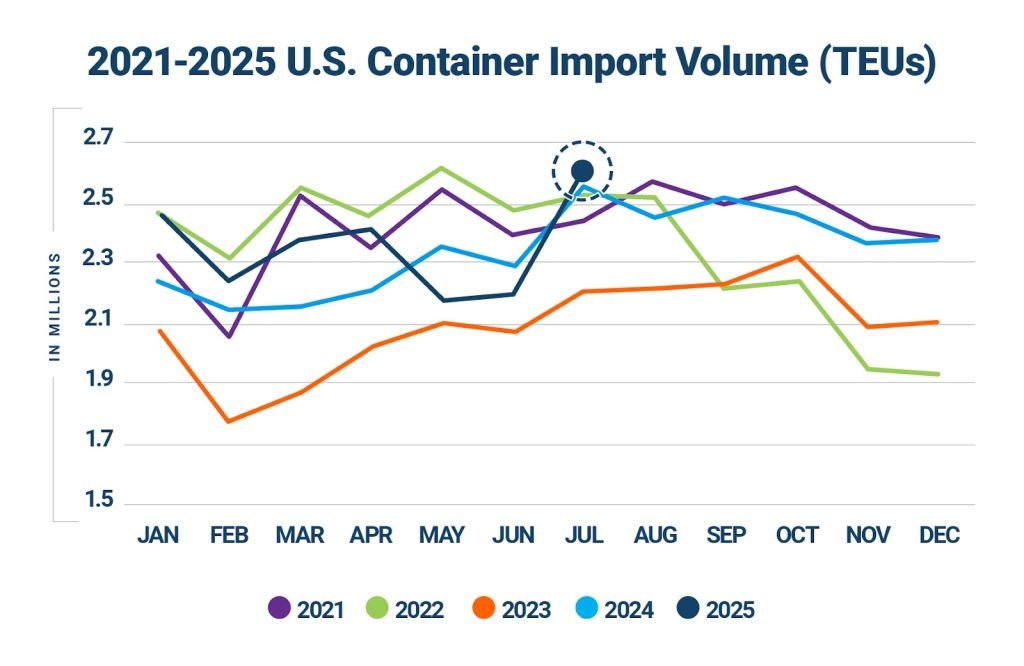

July Imports Hit Record High, But Clouds Loom for Rest of 2025

NEW YORK, August 20, 2025 — U.S. ports handled more cargo in July than at any other point this year. Nearly 3.01 million TEUs moved through the nation’s gateways, a 3.7 percent jump compared with last summer. The figures mark a 2025 peak — and a moment of relief for retailers stocking up ahead of the holiday season.

But the optimism has limits. Analysts at S&P Global Market Intelligence warn the surge may not last. Their forecast points to a slowdown in the third and fourth quarters, as higher tariffs, cooling consumer demand, and inventory overhang begin to bite.

Port operators say they felt the rush firsthand. “The yard was packed every night in July,” said a terminal supervisor in Long Beach. “We cleared it, but just barely.” Rail operators and trucking firms also reported longer turnaround times, with some shipments waiting days before leaving the port.

The reasons behind the spike are mixed. Importers advanced orders to get ahead of possible tariff changes, while others rushed to rebuild stockpiles drained earlier in the year. The result was record volume that stretched capacity to its limit.

If S&P’s outlook proves accurate, August may be the high-water mark before traffic eases. That could bring relief for port workers and truckers who have been running flat out — but it also raises fresh concerns for shipping lines and logistics providers banking on a strong second half.

For now, the docks are quiet again, but no one is betting on stability. As one analyst put it: “Peaks are easy to see. The trouble is always what comes after.”

The post July Imports Hit Record High, But Clouds Loom for Rest of 2025 appeared first on The Logistic News.

Share this post

Related

Posts

Drone attacks disrupt operations at Oman’s major ports

Operations at several major Omani maritime facilities have been disrupted following drone attacks targeting the ports of Duqm and Salalah,...

London marine insurers expand Middle East war-risk zones

Marine insurers in London have expanded the list of high-risk maritime areas in response to escalating hostilities across the Middle...

MSC declares “end of voyage” for Arabian Gulf shipments

Global container shipping leader MSC has declared an “End of Voyage” for all cargo currently bound for ports in the...

UECC strengthens green fleet with two new hybrid car carriers

European vehicle carrier United European Car Carriers (UECC) has confirmed the order of two new multi-fuel battery-hybrid Pure Car and...